4 Renovations That Decrease the Value of Your Home

Posted: February 3, 2016 Filed under: Selling Your Home, Your Home | Tags: renovations; home improvement; dfw real estate; realtor plano; Comments Off on 4 Renovations That Decrease the Value of Your Home I always advocate contacting me before you update your home. There are so many important factors to consider. Your home is one of the largest investments you have, so you should always consider the value of any changes or updates. The recent Cost vs Value report showed you the return on investment for the most popular upgrades. But as outlined in a recent article on MarketWatch, some renovations can actually decrease the value of your home.

I always advocate contacting me before you update your home. There are so many important factors to consider. Your home is one of the largest investments you have, so you should always consider the value of any changes or updates. The recent Cost vs Value report showed you the return on investment for the most popular upgrades. But as outlined in a recent article on MarketWatch, some renovations can actually decrease the value of your home.

The four following renovations can often result in a decrease in value of your home:

- Removing Bedrooms – While you might see larger rooms as a plus, generally, the more bedrooms that are in your home, the higher the price it can demand. You will also likely reduce the amount of buyers interested in your home, since most buyers start their search based on number of bedrooms.

- Removing Closets – While you might enjoy a larger bathroom, the large majority of buyers will demand closet space. It can be a large selling point for a home.

- Turning the Garage into a Living Area – As good as this can sound to give you another living area, most buyers consider a garage a necessity. Not only are you removing a parking area, but you are also removing valuable storage space, from the buyer’s perspective.

- Wallpaper – While it is possible to remove wallpaper, it can be a difficult job (and expensive if you have someone do it for you). Buyers can generally overlook paint colors that can be changed, but having to remove an overabundance of wallpaper can be a definite deterrent.

Ready to renovate your home? Call me! 972-824-6466

For the full article, click HERE.

2016 Remodeling Cost vs. Value Report

Posted: January 28, 2016 Filed under: Selling Your Home | Tags: cost vs value; return on investment; home upgrades; remodeling; DFW real estate Comments Off on 2016 Remodeling Cost vs. Value Report Is 2016 your year to sell? It’s important to know which home improvement projects will bring you the most return on your investment. Visit the 2016 Cost vs Value Report (see Dallas specific info here) which compares the 30 most popular remodeling projects and the value those projects retain at resale. If you’re making updates or just thinking about selling, let’s talk about how it will affect the value of your home!

Is 2016 your year to sell? It’s important to know which home improvement projects will bring you the most return on your investment. Visit the 2016 Cost vs Value Report (see Dallas specific info here) which compares the 30 most popular remodeling projects and the value those projects retain at resale. If you’re making updates or just thinking about selling, let’s talk about how it will affect the value of your home!

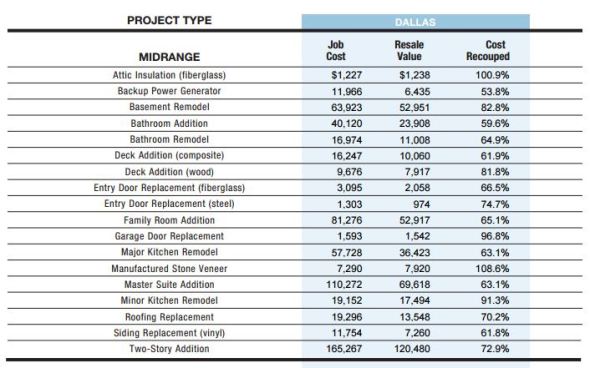

The Cost vs. Value report is an annual collaboration between Remodeling magazine and REALTOR® Magazine, which breaks down the estimated cost of various remodeling projects and the estimated return on investment for those projects by region and by city, as well as by midrange and upscale projects.

The 2016 report shows some noticeable changes from last year’s report – showing energy efficiency and curb appeal to be two driving factors. But the report still boasts that less is more, with four of the five top ranking projects costing less than $5000. According to the report, the average is around a 64% return on investment, which is up from last year. The top spot, though, belongs to attic insulation – which shows a 100% return!

(Below is an excerpt of midrange improvements from the Dallas-specific report from remodeling.net)

Want to read more? Check out THIS article from realtor.com giving a great top-level view of the report. If you want details on the key trends, go HERE on the remodeling.net report.

Ready to make some updates on your home before selling? Call me at 972-824-6466 and let’s discuss the best changes to make. I can also help with contractor referrals! The market is still hot and 2016 is a great time to sell!

4 Expenses You Avoid When Working With a Seller’s Agent

Posted: January 11, 2016 Filed under: Selling Your Home | Tags: DFW Real Estate, for sale by owner, FSBO, realtor vs FSBO, Selling your Home, why use a realtor Comments Off on 4 Expenses You Avoid When Working With a Seller’s AgentIt might be tempting to sell your own home. You might think you are saving by not paying an agent’s fee and only have to hold an open house and deal with some paperwork. However, statistics have shown that sellers tend to make more money when they hire a Realtor. According to the National Association of Realtors®, an agent-assisted home sale has a 13 percent higher sales price than a FSBO (For Sale By Owner).

Here are a just a few ways you save with an agent.

1. The price is right

Pricing your home is one of the most challenging parts of selling. A Realtor is highly experienced in this area and can help you avoid pitfalls. For instance, over-pricing may leave your home languishing on the market and if you start dropping it, you can be seen as desperate and bring in low-ball offers. On the other hand, if you price too low, you’re leaving money on the table that could be in your hands – something you probably don’t want to do when selling your most valuable asset.

2. Marketing

Let’s face it, you have to spread the word about your property. Paying for online listings, mailers and signs can be expensive. Most Realtors already have a plan in place for marketing as well as the connections to spread the word quickly and efficiently and usually at no added cost. This can also relieve a lot of stress off the seller.

3. Negotiations

No matter how well your home is priced, you will likely find yourself negotiating with the buyer. This is where an agent’s skill and experience will really help you get a fair price. Not to mention the fact that most buyers think they can negotiate a real deal if you are selling the home yourself. Do you know what your home is really worth in the current market to back up your price?

4. Time is money

Let’s face it, life is busy. Adding tasks like creating marketing materials, arranging showings, finding contractors, negotiating, reviewing documents, etc will cost you both time and money, as well as add a lot of stress. Let a Realtor that performs these duties daily and has resources at his/her fingertips do the work for you and help you open your schedule and sell your home faster.

Reconsidering your FSBO status? Contact Gwen at 972-824-6466 or gwen@gwenwood.com

— article adapted from ABOVE, The Re/Max Magazine —

Think You Should FSBO? Think Again!

Posted: June 17, 2015 Filed under: Selling Your Home Comments Off on Think You Should FSBO? Think Again!Some Highlights:

According to NAR’s Profile of Home Buyers & Sellers:

- 88% of buyers look for their new home online

- Using a real estate agent can net you 13% more than FSBO’ing

- There is a long list of people that you will have to negotiate with when you decide to sell your home, using an experienced professional can help ease the process.

– Keeping Current Matters; 12 June 2015 –

We Need You(r House)!!

Posted: April 21, 2015 Filed under: Selling Your Home Comments Off on We Need You(r House)!!Though the real estate market has improved, we still have one item holding it back from a full recovery – a robust supply of homes for sale. Demand has increased dramatically. At the same time, housing inventory is decreasing especially at the lower price points.

The National Association of Realtors (NAR) recently revealed that there is a pent-up seller demand caused by the uncertainty created by the housing crisis of the last decade.

What does that mean to you?

Houses listed today sell quickly. With prices still below peak values of 2007 in many parts of the country and mortgage interest rates at historic lows, this may be the perfect time for your family to make the move to the dream house you always wanted – whether that’s a larger home or that vacation/retirement home you have been looking at.

What does that mean to the economy?

Housing has always been an essential part of the U.S. economy. As we have reported before, real estate not only provides housing for families. It is often the greatest source of wealth and savings for many. The recent increase in real estate sales has led to an increase in real estate prices. This has increased the value of everyone’s’ home, whether they are selling or not. This leads to an increase in consumer confidence which in turn leads to an increase in consumer spending. Plus, each home sale automatically puts money into the economy.

NAR compiled data from research conducted by the Bureau of Economic Analysis & Macroeconomic Advisors on the economic impact of a home purchase.

After reviewing the data, they concluded that the total economic impact of a typical home sale in the United States is an astonishing $52,205.

The more homes that sell, the better the economy.

Bottom Line

In order for the U.S. economy to get better, we need to sell more homes. Perhaps, it makes sense for one of those homes to be yours.

If you have considered selling but are still a little nervous, now might be the time to sit down with a real estate professional familiar with your market and see what your options truly are.

– Keeping Current Matters; 21 April 2015 –

Why You Should Sell Now

Posted: March 30, 2015 Filed under: Housing Market Info, Selling Your Home 1 CommentAs the temperature rises, buyers are coming out ready to purchase their dream home. Inventory is still below historic numbers and demand is strong. Don’t miss out on this great opportunity for you and your family.

Here are five reasons to list your home now.

1. Demand is Strong

Foot traffic refers to the number of people out actually physically looking at homes right now. The latest foot traffic numbers show that there are more prospective purchasers currently looking at homes than at any other time in the last 12 months which includes last spring’s buyers’ market. These buyers are ready, willing and able to purchase… and are in the market right now!

Take advantage of the buyer activity currently in the market.

2. There Is Less Competition Now

Housing supply just dropped to 4.6 months, which is under the 6 months’ supply that is needed for a normal housing market. This means, in many areas, there are not enough homes for sale to satisfy the number of buyers in that market. This is good news for home prices. However, additional inventory is about to come to market.

There is a pent-up desire for many homeowners to move as they were unable to sell over the last few years because of a negative equity situation. Homeowners are now seeing a return to positive equity as real estate values have increased over the last two years. Many of these homes will be coming to the market in the near future.

Also, new construction of single-family homes is again beginning to increase. A study by Harris Poll revealed that 41% of buyers would prefer to buy a new home while only 21% prefer an existing home (38% had no preference).

The choices buyers have will continue to increase. Don’t wait until all this other inventory of homes comes to market before you sell.

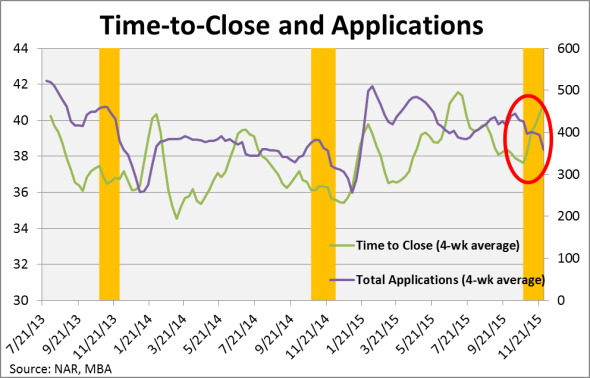

3. The Process Will Be Quicker

One of the biggest challenges of the housing market in recent times has been the length of time it takes from contract to closing. Banks are requiring more and more paperwork before approving a mortgage. As the market heats up, banks will be inundated with loan inquiries causing closing timelines to lengthen. Selling now will make the process quicker & simpler.

4. There Will Never Be a Better Time to Move-Up

If you are moving up to a larger, more expensive home, consider doing it now. Prices are projected to appreciate by over 19.3% from now to 2019. If you are moving to a higher priced home, it will wind-up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. You can also lock-in your 30-year housing expense with an interest rate under 4% right now. Rates are projected to increase by about three quarters of a percent by the end of 2015.

5. It’s Time to Move On with Your Life

Look at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should?

Only you know the answers to the questions above. You have the power to take back control of the situation by putting your home on the market. Perhaps, the time has come for you and your family to move on and start living the life you desire.

That is what is truly important.

– Keeping Current Matters; 30 March 2015 –

Every year at this time, many homeowners decide to wait until after the holidays to put their home on the market for the first time. Others who already have their home on the market decide to take it off the market until after the holidays. Here are six great reasons not to wait:

Every year at this time, many homeowners decide to wait until after the holidays to put their home on the market for the first time. Others who already have their home on the market decide to take it off the market until after the holidays. Here are six great reasons not to wait: